The Facts About Custom Private Equity Asset Managers Uncovered

Wiki Article

Custom Private Equity Asset Managers Fundamentals Explained

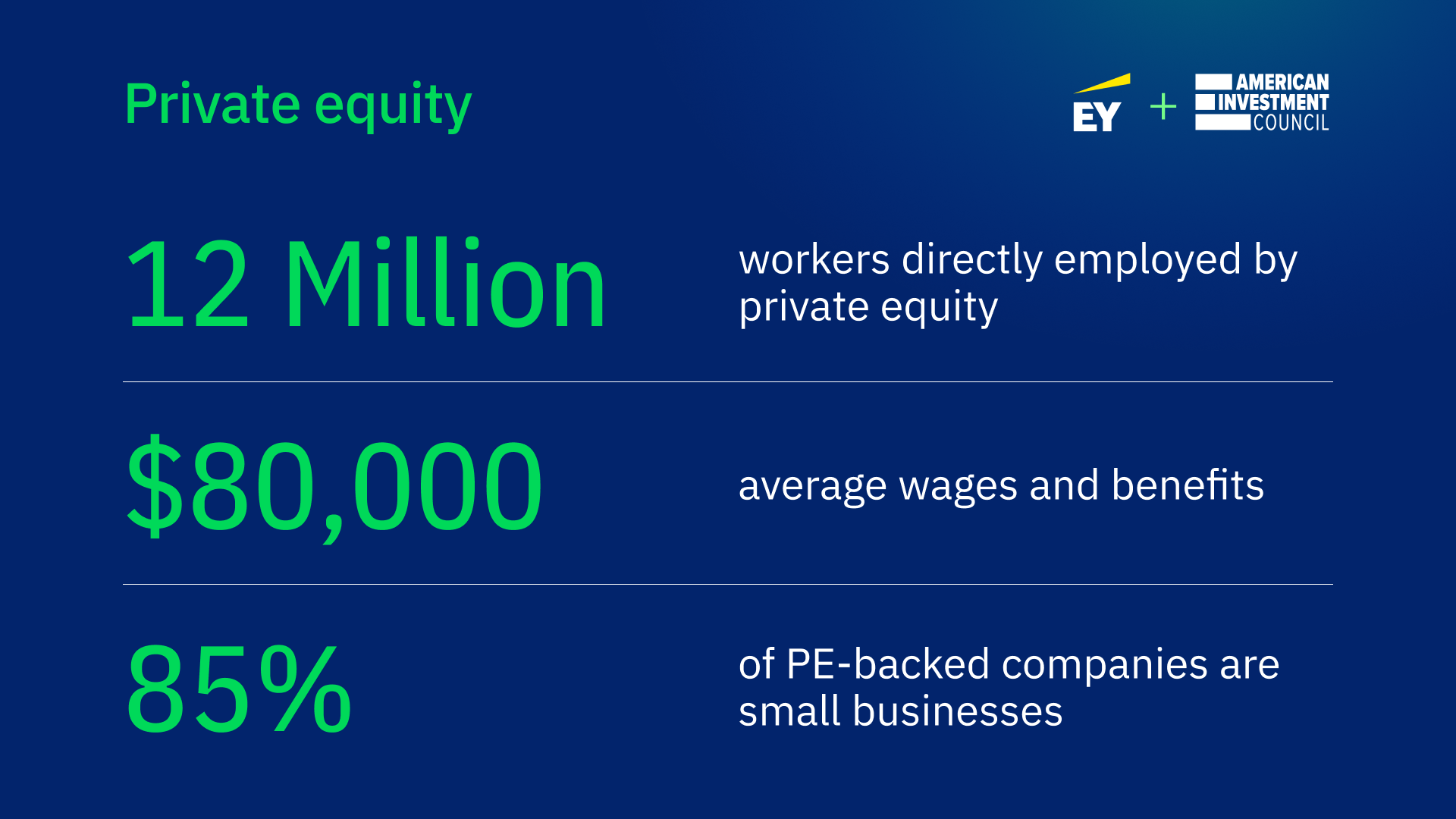

You've probably become aware of the term exclusive equity (PE): purchasing firms that are not openly traded. Approximately $11. 7 trillion in assets were handled by personal markets in 2022. PE firms look for opportunities to earn returns that are far better than what can be accomplished in public equity markets. But there may be a couple of things you don't understand concerning the market.

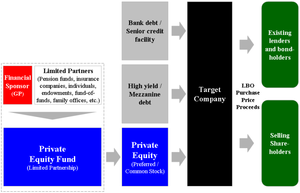

Companions at PE firms elevate funds and manage the cash to generate positive returns for investors, typically with an financial investment horizon of in between four and seven years. Exclusive equity firms have a range of financial investment preferences. Some are strict financiers or easy financiers wholly depending on monitoring to grow the firm and create returns.

Since the very best gravitate towards the bigger deals, the center market is a substantially underserved market. There are more vendors than there are extremely seasoned and well-positioned money experts with considerable buyer networks and sources to take care of a deal. The returns of private equity are typically seen after a few years.

The Definitive Guide to Custom Private Equity Asset Managers

Flying below the radar of big international firms, much of these little companies commonly provide higher-quality customer care and/or niche product or services that are not being supplied by the big conglomerates (https://www.imdb.com/user/ur173700848/?ref_=nv_usr_prof_2). Such advantages attract the interest of personal equity firms, as they have the insights and savvy to exploit such chances and take the business to the next level

Personal equity next capitalists must have reliable, qualified, and trustworthy administration in location. The majority of managers at profile business are given equity and reward compensation structures that compensate them for striking their economic targets. Such positioning of objectives is usually needed before a bargain obtains done. Exclusive equity chances are typically out of reach for individuals that can't invest countless dollars, however they shouldn't be.

There are guidelines, such as limitations on the aggregate quantity of cash and on the variety of non-accredited investors. The personal equity company brings in several of the very best and brightest in company America, including top entertainers from Ton of money 500 business and elite management consulting firms. Legislation companies can likewise be recruiting premises for private equity hires, as audit and lawful abilities are required to complete offers, and transactions are highly sought after. https://www.intensedebate.com/people/cpequityamtx.

The Definitive Guide to Custom Private Equity Asset Managers

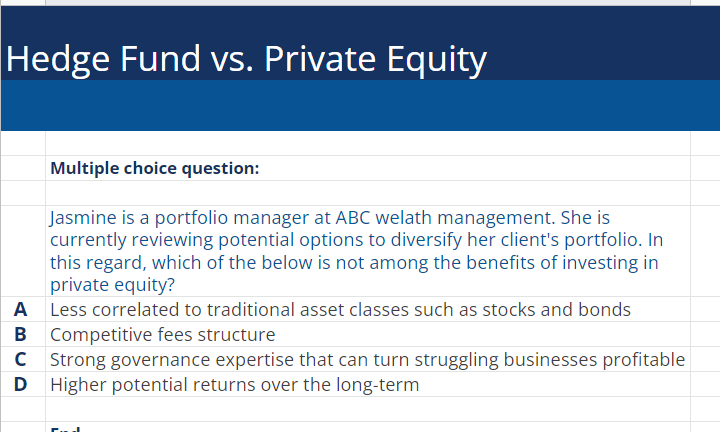

An additional negative aspect is the absence of liquidity; when in an exclusive equity transaction, it is difficult to obtain out of or sell. There is an absence of adaptability. Private equity likewise comes with high fees. With funds under monitoring currently in the trillions, exclusive equity companies have actually ended up being eye-catching financial investment automobiles for wealthy people and institutions.

For years, the qualities of private equity have actually made the asset class an appealing suggestion for those that can take part. Now that accessibility to personal equity is opening up to more private investors, the untapped capacity is coming true. The concern to take into consideration is: why should you invest? We'll begin with the major disagreements for spending in personal equity: Just how and why private equity returns have traditionally been higher than various other possessions on a number of levels, How consisting of exclusive equity in a portfolio influences the risk-return profile, by helping to branch out against market and intermittent danger, Then, we will detail some vital factors to consider and threats for private equity capitalists.

When it pertains to presenting a new property right into a portfolio, the most fundamental factor to consider is the risk-return profile of that asset. Historically, exclusive equity has shown returns similar to that of Arising Market Equities and higher than all various other standard asset classes. Its relatively reduced volatility paired with its high returns produces a compelling risk-return profile.

Not known Incorrect Statements About Custom Private Equity Asset Managers

As a matter of fact, personal equity fund quartiles have the widest series of returns across all different asset courses - as you can see listed below. Method: Inner rate of return (IRR) spreads out calculated for funds within vintage years independently and after that averaged out. Median IRR was computed bytaking the standard of the average IRR for funds within each vintage year.

The effect of including private equity into a portfolio is - as constantly - reliant on the profile itself. A Pantheon study from 2015 suggested that including exclusive equity in a profile of pure public equity can open 3.

On the other hand, the most effective personal equity companies have accessibility to an also bigger swimming pool of unidentified opportunities that do not encounter the same examination, in addition to the resources to carry out due diligence on them and determine which deserve buying (Private Equity Platform Investment). Spending at the ground floor suggests greater risk, but also for the companies that do be successful, the fund advantages from greater returns

Things about Custom Private Equity Asset Managers

Both public and private equity fund supervisors commit to investing a percent of the fund yet there remains a well-trodden problem with aligning passions for public equity fund administration: the 'principal-agent issue'. When an investor (the 'primary') hires a public fund manager to take control of their funding (as an 'representative') they entrust control to the manager while preserving ownership of the possessions.

In the case of private equity, the General Companion doesn't just make a monitoring charge. Private equity funds also mitigate one more kind of principal-agent problem.

A public equity capitalist inevitably desires one point - for the monitoring to increase the stock cost and/or pay rewards. The financier has little to no control over the choice. We revealed over the number of personal equity strategies - specifically majority acquistions - take control of the operating of the business, making sure that the long-term value of the company precedes, raising the return on financial investment over the life of the fund.

Report this wiki page